Lookup - Tax Code

Tax Code

Define tax percent applied to each of your inventory item, or the additional tax which applied to the Sub Total. Tax Code is used in:

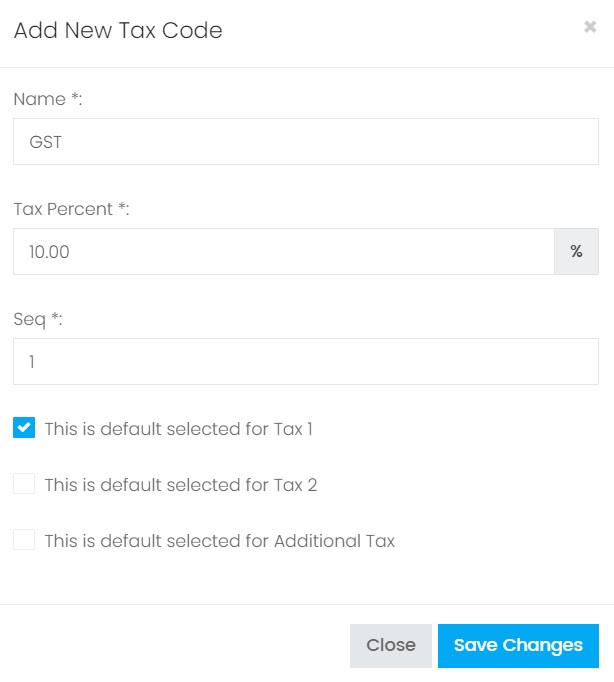

Create a Tax Code

1. On the left menu, choose Setting > System Setting. Expand the Lookup tab. Choose Tax Code. Click on New button on the top right of the page. When you set a Tax Code as Default Tax 1 or 2, meaning this Tax Code will be auto selected when you generate any business document.

2. Enter the information, choose Save Changes to save the record.

| Column | Description |

|---|---|

| Name | The name of the Tax Code. |

| Tax Percent | Ratio at which an item is taxed. |

| Seq | Set the sequence of the Tax Code listing. When showing in the dropdown option the Tax Code record will be listing based on the sequence value in ascending. |

| This is default selected | Only 1 record can be set as default selected. When showing the Tax Code listing in dropdown option, the record which has been set as default selected will be auto selected as the default option value. |

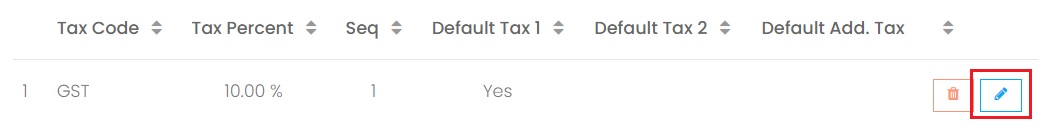

Edit a Tax Code

1. Choose the blue color edit button of the record you want to update from the Tax Code Listing.

2. The detail information of the Tax Code record will be shown. Make modification and choose button Save Changes.

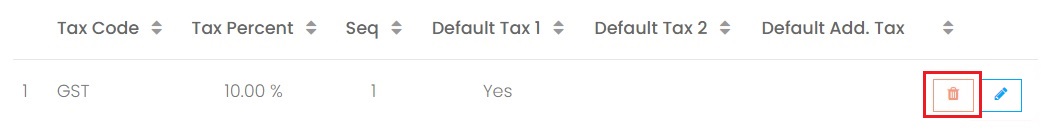

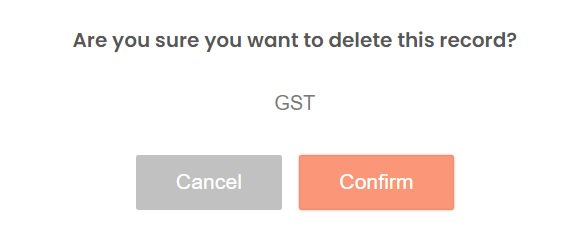

Delete a Tax Code

1. Choose the red color delete button of the record you want to delete from the Tax Code Listing.

2. On the popup confirmation message box, choose Confirm to proceed delete the record.

Next topic: Currency

Previous topic: Shipping Terms

Need help?

Connect with us

New to Xin 365?

Sign up today